ASU 2016-01 – Accounting for Equity Securities

By Charles Hall | Accounting

Are you aware of the coming changes in accounting for equity securities with ASU 2016-01?

In the past, FASB required that changes in the fair value of available-for-sale equity investments be parked in accumulated other comprehensive income (an equity account) until realized--that is, until the equity investment was sold. In other words, the unrealized gains and losses of equity investments were not recognized in net income until the investments were sold. This is about to change.

Changes in equity investments will generally be reflected in net income as they occur--even before the equity investments are sold.

The guidance for classifying and measuring investments in debt securities is unchanged.

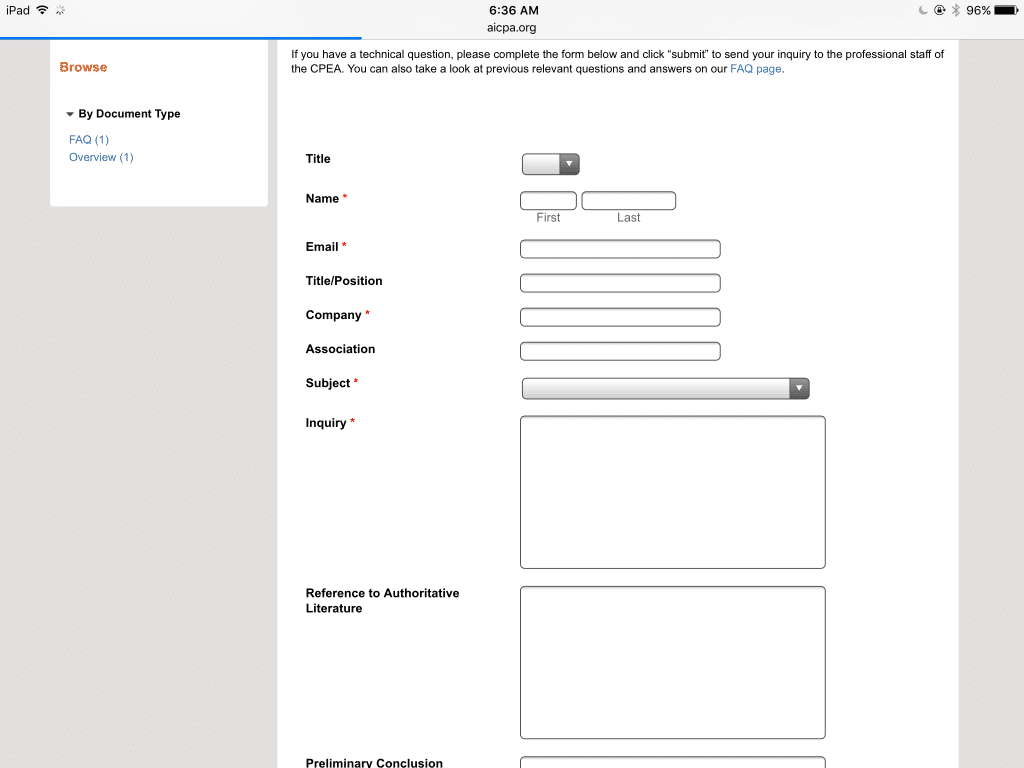

On January 5, 2016, FASB issued ASU 2016-01 Recognition and Measurement of Financial Assets and Financial Liabilities. Here's the lowdown.

Changes in Accounting for Equity Securities - ASU 2016-01

First, ASU 2016-01 removes the current guidance regarding classification of equity securities into different categories (i.e., trading or available-for-sale).

Secondly, the new standard requires that equity investments generally be measured at fair value with changes in fair value recognized in net income (see exceptions below). Companies will no longer recognize changes in the value of available-for-sale equity investments in other comprehensive income (as we have in the past).

Exceptions

ASU 2016-01 generally requires that equity investments be measured at fair value with changes in fair value recognized in net income. There are some equity investments that are not treated in this manner such as equity method investments and those that result in consolidation of the investee.

Is the accounting for equity investments without readily determinable fair values different? It can be.

Equity Investments without Readily Determinable Fair Values

An entity may choose to measure equity investments that do not have readily determinable fair values at cost minus impairment. This election should be documented at the time of adoption (for existing securities) or at the time of purchase for securities acquired subsequent to the date of adoption. The alternative can be elected on an investment-by-investment basis.

Why make the election to measure equity investments that do not have readily determinable fair values at cost minus impairment? Because of the difficulty of determining the fair value of such investments. This election will probably be used by entities that previously carried investments at cost.

ASU 2016-01 requires that equity investments without readily determinable fair values undergo a one-step qualitative assessment to identify impairment (similar to what we do with long-lived assets and goodwill).

At each reporting period, an entity that holds an equity security shall make a qualitative assessment considering impairment indicators to evaluate whether the investment is impaired. Impairment indicators that an entity considers include, but are not limited to, the following:

- A significant deterioration in the earnings performance, credit rating, asset quality, or business prospects of the investee

- A significant adverse change in the regulatory, economic, or technological environment of the investee

- A significant adverse change in the general market condition of either the geographical area or the industry in which the investee operates

- A bona fide offer to purchase, an offer by the investee to sell, or a completed auction process for the same or similar investment for an amount less than the carrying amount of that investment

- Factors that raise significant concerns about the investee’s ability to continue as a going concern, such as negative cash flows from operations, working capital deficiencies, or noncompliance with statutory capital requirements or debt covenants.

So what happens if there is an impairment?

The FASB Codification (321-10-35-3) states the investment shall be written down to its fair value if a qualitative assessment indicates that the investment is impaired and the fair value of the investment is less than its carrying value.

How is the impairment reflected in the income statement?

If an equity security without a readily determinable fair value is impaired, the entity should include the impairment loss in net income equal to the difference between the fair value of the investment and its carrying amount.

Presentation of Financial Instruments

Entities are to present their financial assets and liabilities separately in the balance sheet or in the notes to the financial statements. This disaggregated information is to be presented by:

- Measurement category (i.e., cost, fair value-net income, and fair value-OCI

- Form of financial asset (i.e., securities or loans and receivables)

So, financial assets measured at fair value through net income are to be presented separately from assets measured at fair value through other comprehensive income.

Debt Securities Accounting

U.S. GAAP for classification and measurement of debt securities remains the same. Show unrealized holding gains and losses on available-for-sale debt securities in other comprehensive income.

Disclosure Eliminated - Financial Instruments Measured at Amortized Cost

ASU 2016-01 removes a prior disclosure requirement. In the past, entities disclosed the fair value of financial instruments measured at amortized cost. Examples include notes receivables, notes payable, and debt securities. ASU 2016-01 removes this disclosure requirement for entities that are not public business entities.

Effective Dates for ASU 2016-01

ASU 2016-01 says the following concerning effective dates:

For public business entities, the amendments in this Update are effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years.

For all other entities including not-for-profit entities and employee benefit plans within the scope of Topics 960 through 965 on plan accounting, the amendments in this Update are effective for fiscal years beginning after December 15, 2018, and interim periods within fiscal years beginning after December 15, 2019. All entities that are not public business entities may adopt the amendments in this Update earlier as of the fiscal years beginning after December 15, 2017, including interim periods within those fiscal years.

Also, the provision exempting nonpublic entities from the requirement to disclose fair values of financial instruments can be early adopted.

Initial Accounting for ASU 2016-01

An entity should apply the ASU 2016-01 amendments by means of a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption.

The amendments related to equity securities without readily determinable fair values (including disclosure requirements) should be applied prospectively to equity investments that exist as of the date of adoption of ASU 2016-01.