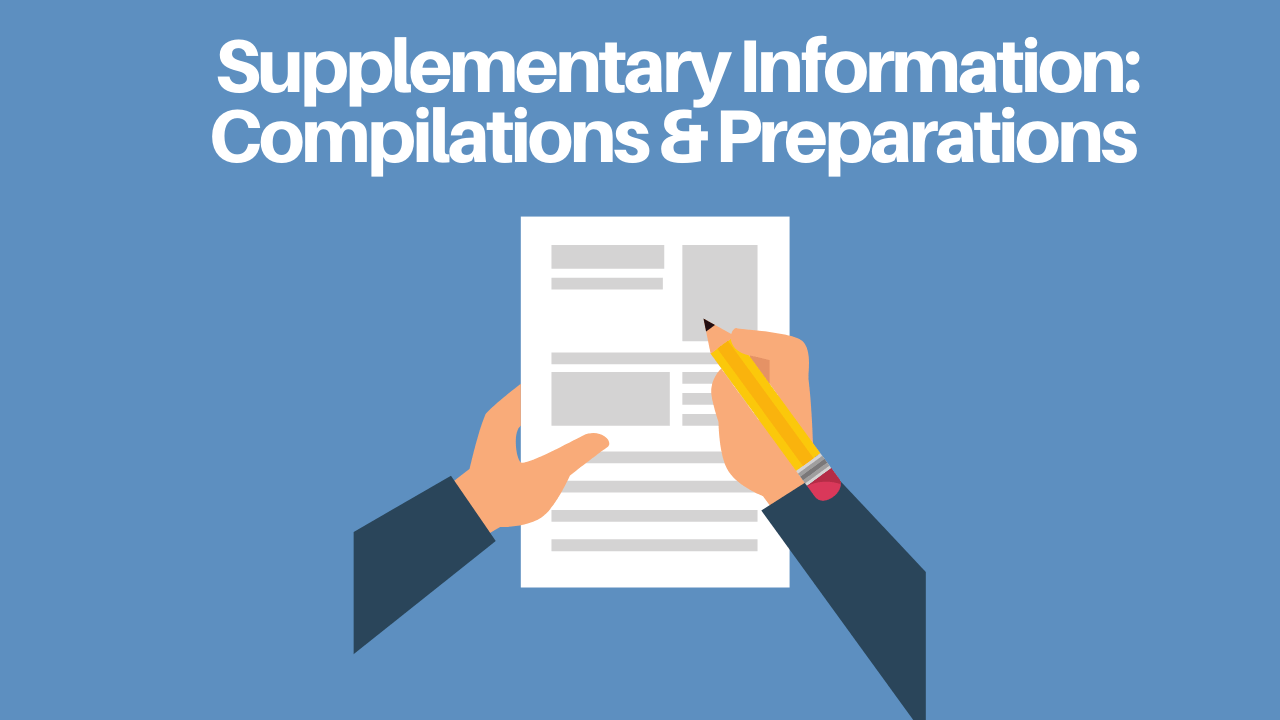

How to Address Supplementary Information in Compilation and Preparation Engagements

Are you wondering how to present supplementary information in compilation and preparation engagements? What supplementary information (SI) should be included? How does the accountant define his or her responsibility for SI?

Often accountants, at the request of their clients, add supplementary information to the financial statements. Such information is never required (to be in compliance with a reporting framework) but may be useful.

You can think of financials with supplementary information in this manner:

Financial statements – Required – The jeep in the picture above

Supplementary Information – Not required – The camper

You’re not going anywhere without a vehicle (it’s required). And your camper (not required) is no good without an automobile to pull it. Kind of a silly analogy, I know, but maybe it helps.

I normally add a divider page between the financial statements and supplementary information (though such as page is not required); the divider page simply says “Supplementary Information” and nothing else.

AR-C 80, Compilation Engagements, defines supplementary information as follows:

Information presented outside the basic financial statements, excluding required supplementary information, that is not considered necessary for the financial statements to be fairly presented in accordance with the applicable financial reporting framework.

Supplementary information normally follows the notes to the financial statements; if the notes are omitted, then the supplementary information usually follows the last financial statement presented in the basic financial statements. (Required supplementary information seldom comes into play; an example, is the inclusion of management, discussion and analysis in governmental financial statements.)

AR-C 80 defines basic financial statements as follows:

Financial statements excluding supplementary information and required supplementary information.

Structure of Financial Statements

Commonly the basic financial statements and supplementary information are arranged as follows:

- Financial statements

- Notes to the financial statements

- Supplementary information

Sample Supplementary Information

Examples include:

- Schedule of operating expenses

- Schedule of other income

- Schedule of other expenses

- Schedule of the number of employees by division

- Schedule of inventory locations

- Schedule of uncompleted construction contracts

- Schedule of contractual income

- Consolidating balance sheet

- Consolidating statement of income

If you need to include information not required by the accounting framework (e.g., GAAP), then consider adding supplementary information. Bankers or owners sometimes desire such information. You won’t find this supplementary information in a disclosure checklist but it may be needed to allow the owner to see how profitable an individual division is or it may provide a banker with additional inventory information. Sometimes the owner has a contract to pay a third party based on a computation. Supplementary information gives you a place for such information. As you will see below, the supplementary information can be subject to compilation procedure–or not.

Consolidating Statements

Typically SI is titled as a schedule to distinguish it from the basic financial statements. Nevertheless, if consolidated statements are presented in the basic financial statements, it is appropriate to include the consolidating financial statements—the presentation of each separate entity in columnar fashion being brought together into a consolidated total—in the supplementary information. Consolidating financial statements should be titled as statements rather than as schedules.

Supplementary Information and a Preparation Engagement

Section 70, Preparation of Financial Statements can be applied to supplementary information (see Section 70, .A3). Consider your level of responsibility for such information and communicate clearly in your engagement letter and financial statements that no assurance is provided. Technically, the “no assurance is provided” language is only required for financial statement pages (see Section 70, paragraph .14); nevertheless, consider adding it to your supplementary information pages.

Supplementary Information and a Compilation Engagement

Section 80, Compilation Engagements does address the inclusion of supplementary information. If SI is included, the accountant should communicate his degree of responsibility in either:

- An other-matter paragraph in the compilation report or

- A separate report

If the degree of responsibility is communicated in a separate report, that report usually follows the notes to the financial statement and precedes the supplementary information. To minimize the number of pages in the report, consider communicating your degree of responsibility in an other-matter paragraph in the compilation report.

Did the accountant apply compilation procedures to SI? If yes, then the compilation report wording is as follows:

The accompanying [identify the supplementary information] is presented for purposes of additional analysis and is not a required part of the basic financial statements. Such information is the responsibility of management. The supplementary information was subject to our compilation engagement. We have not audited or reviewed the supplementary information and do not express an opinion, a conclusion, nor provide any assurance on such information.

If the accountant does not apply compilation procedures to SI, the compilation report wording is as follows:

The accompanying [identify the supplementary information] is presented for purposes of additional analysis and is not a required part of the basic financial statements. Such information is the responsibility of management. The supplementary information was not subject to our compilation engagement. We do not express an opinion, a conclusion, nor provide any assurance on such information.

References

Include a reference to the compilation report on each page of the supplementary information such as:

- See Accountant’s Report or

- See Accountant’s Compilation Report

That way, if the SI becomes detached from the report, the reader (of the SI) can see a report was issued.

Supplementary Information – Simple Summary

- Supplementary information is, by definition, not required in financial statements prepared using the preparation or compilation guidance.

- Supplementary information is normally included to provide additional details of information that owners or lenders desire to see.

- Supplementary information is normally titled as a schedule rather than as a statement to differentiate the supplementary information from the basic financial statements. It is appropriate to title consolidating or combining financial statements included in the supplementary information as statements.

- If supplementary information is included in financial statements issued in a preparation engagement, define your responsibility in the statements/schedules or notes.

- If supplementary information is included in financial statements issued in a compilation engagement, define your responsibility in the compilation report (using an other-matter paragraph) or in a separate report (which precedes the supplementary information).

See my article about audited supplementary information.