Accountant’s Scanning System: How to Build

By Charles Hall | Technology

In this article, I tell you how to build an accountant’s scanning system.

Are you overwhelmed by stacks of paper? Do you find it difficult to locate the information you know you have? Today, I teach you how to build an accountant’s scanning system.

Accountant’s Scanning System

I have the privilege of visiting other CPA firms, and our firm has about 120 people, so I have the opportunity to see plenty of offices. It is my observation that some CPAs are paperless, but many are not.

One problem with “paper everywhere” is we can’t find what we need. We have it (somewhere), but we can’t find it. Scanning is the easiest way to capture and organize the paper monster.

To create order, take three steps:

- Buy a scanner

- Build a scanning structure

- Build scanning habits

1. Buy a Scanner

My scanner is a Fujitsu iX500. (There is a newer model now, the iX1500.) It sits just to my right in my office, so I don’t have to leave my desk to scan. Convenience is key to creating order. Otherwise, you will think I’ll scan that later, but it doesn’t happen. Then the paper litters your desk–and distracts you.

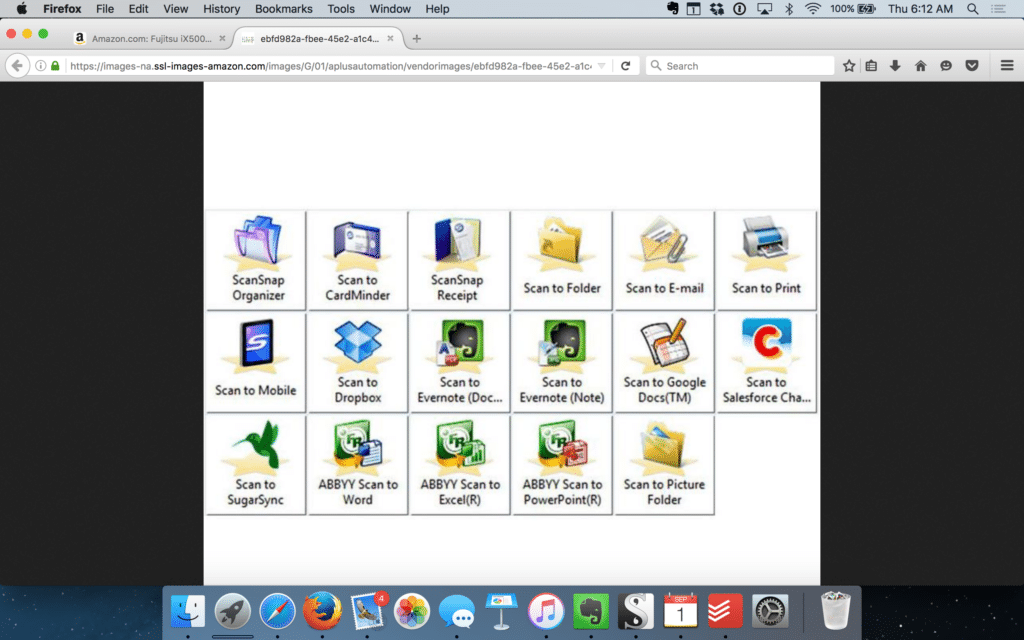

The iX1500 costs $420, so it’s not a huge cash outlay. The scanner’s footprint is small (the dimensions are 11.5 x 6 x 6.3 inches) and it weighs 7.5 pounds. Also, the scanner comes with software (ScanSnap) that offers you destinations such as these:

I often scan to Evernote, my cloud-based library. (Amazon also offers Fujitsu ScanSnap iX1500 Document Scanner with Evernote Premium.) If I were buying my first scanner and didn’t have cloud-based storage, this would be my choice.

Another favorite destination: Caseware, our paperless engagement software.

2. Build a Scanning Structure

So, of course, when you scan, you need final resting places for your documents.

My two primary file locations are:

- Evernote for non-engagement documents

- Caseware for engagement documents

Non-Engagement Documents

If you’ve followed my blog, you know I’m a raving Evernote lunatic. Why?

- Ease of use

- Notebooks (you use notebooks to organize your documents)

- Tags (you can tag each note with multiple tags, making it easy to find the material)

- Feed-ability (I can feed Evernote from my scanner, email, clip-apps, drag and drop, and many other ways)

- Find-ability (Evernote even recognizes hand-written notes making it possible to search electronically and find keywords–even if written)

- Accessibility (I can access Evernote from my iPhone, iPad, and desktop)

- Cost (paid version starts at $7.99 per month; they do offer a free version but with limitations)

- Allows storage of a variety of documents (including Excel, Word, PDF, Audible files)

There are other cloud-based storage systems such as OneNote and Dropbox. Pick one and learn it well.

Engagement Documents

If your audit and tax services are not already paperless, consider making the leap. We have used Caseware for years and, personally, I love it. We use this software for storage of the following engagement files:

- Tax

- Audit

- Reviews

- Compilations

- AUPs

My firm has built templates for each of these services, so everyone in our firm knows where documents (including scans) belong.

To scan promptly, you need to build habits, so creating a repeatable, mental system is critical to the process.

3. Build Scanning Habits

Build your scanning habits. My system is as follows:

- If it takes less than two minutes to scan, scan now

- If it takes more than two minutes, I place the paper in a file tray where I will later batch process

- Scan all paper by the end of the day

- Don’t leave unscanned paper on my desk (it’s a distraction)

- Keep a shred box just below my scanner (where I place sensitive paper documents)

- For long documents (e.g., CPE workbook), ask an assistant to break down the paper copy, scan it, and email it to me (I don’t use my Fujitsu scanner for heavy-duty scanning. We have a copy machine that will convert large scans to PDF.)

Like any new habit, new scanning actions will–at first–feel awkward and inconvenient. But push through the pain and the actions will become routine. (Some of the above thoughts come from David Allen’s book: Getting Things Done—one of the best productivity books you’ll find.)

Act Now

You may feel like the above will take too much time to implement, especially if you have lots of paper. So how do you eat an elephant? One bite at a time.

Schedule your scanning plan. Pick two days a week and put one hour a day on your calendar. Then attack. Slay your paper monster. I dare you.

More Evernote Information

For more information about Evernote, check out these posts: