Financial Statement References

By Charles Hall | Accounting , Preparation, Compilation & Review

What financial statement references are required at the bottom of financial statement pages? Is there a difference in the references in audited statements and those in compilations or reviews? What wording should be placed at the bottom of supplementary pages? Below I answer these questions.

Audited Financial Statements and Supplementary Information

First, let’s look at financial statement references in audit reports.

While generally accepted accounting principles do not require financial page references to the notes, it is a common practice to do so. Here are examples:

- See notes to the financial statements.

- The accompanying notes are an integral part of these financial statements.

- See accompanying notes.

Accountants can also–though not required–reference specific disclosures on a financial statement page. For example, See Note 6 (next to the Inventory line on a balance sheet). It is my preference to use general references such as See accompanying notes.

Audit standards do not require financial statement page references to the audit opinion.

Supplementary pages should not include a reference to the notes or the opinion.

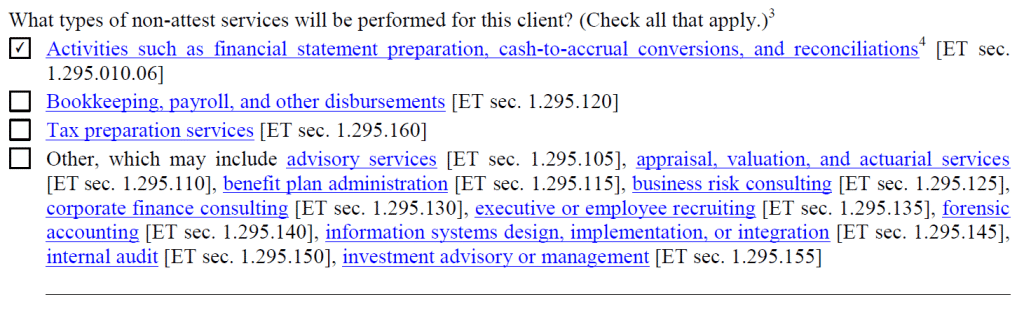

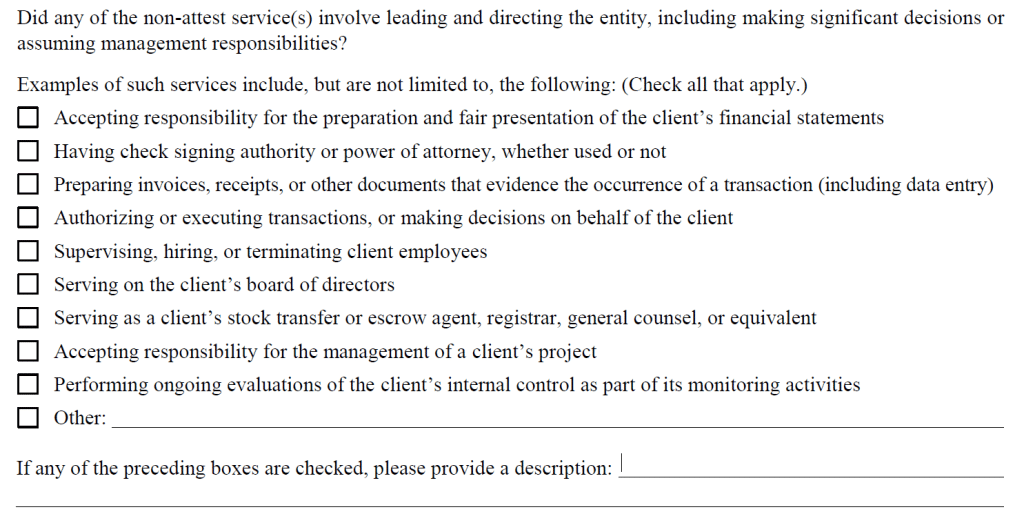

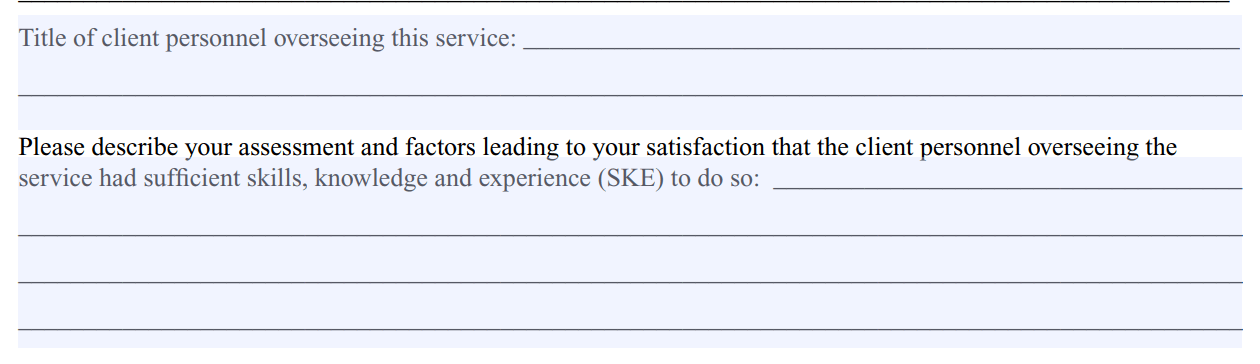

Preparation, Compilation, and Review Engagements

Now, let’s discuss references in preparation, compilation, and review engagements.

Compilation and Review Engagements

The Statements on Standards for Accounting and Review Services (SSARS) do not require a reference (on financial statement pages) to the compilation or review report; however, it is permissible to do so. What do I do? I do not refer to the accountant’s report. I include See accompanying notes at the bottom of each financial statement page (when notes are included). This reference to notes, however, is not required, even when notes are included. (Notes can be omitted in compilation engagements.)

You are not required to include a reference to the accountant’s report on the supplementary information pages. Examples include:

- See Accountant’s Compilation Report.

- See Independent Accountant’s Review Report.

What do I do? I include a reference to the accountant’s report on each supplementary page. But, again, it’s fine to not include a reference to the report.

Preparation of Financial Statement Engagements

Additionally, SSARS provides a nonattest option called the preparation of financial statements (AR-C 70). This option is used by the CPA to issue financial statements that are not subject to the compilation standards. No compilation report is issued. AR-C 70 requires that the accountant either state on each page that “no assurance is provided” or provide a disclaimer that precedes the financial statements. AR-C 70 does not require that the financial statement pages refer to the disclaimer (if provided), but it is permissible to do so. Such a reference might read See Accountant’s Disclaimer.

If your AR-C 70 work product has supplementary information, consider including this same reference (See Accountant’s Disclaimer) on the supplementary pages.